tax on unrealized gains bill

The proposal would allow billionaires to pay this initial tax. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022.

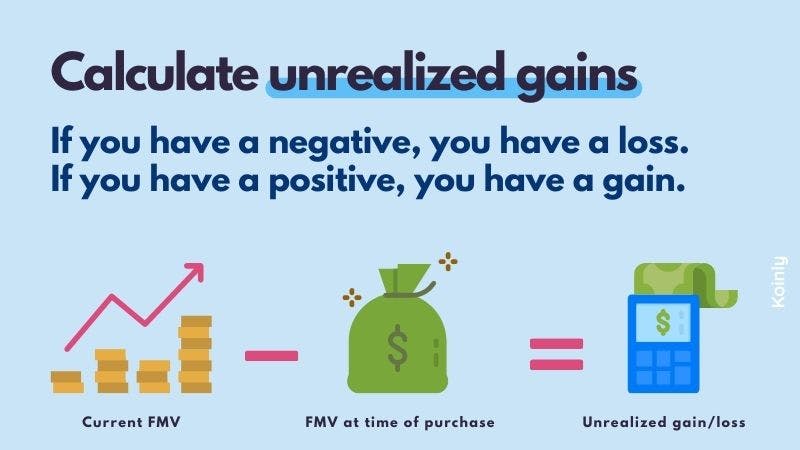

Crypto Tax Unrealized Gains Explained Koinly

She said she expected an agreement reflecting a consensus of all 50 senators on the tax and revenue portion of the bill to emerge early this week.

. However not all realized gains are taxed at the same rate. WASHINGTONA new annual tax on billionaires unrealized capital gains is. Biden is seeking to pay for a proposed 35 trillion.

The potential tax increase being pursued by Senate Finance Chairman Ron Wyden D Ore would be among a number of tax provisions that Mr. President Joe Biden will propose a minimum 20 tax rate that would hit both the income and unrealized capital gains of US. It would apply only to those who do not already pay a tax rate of at least 20 percent on their income and unrealized gains.

But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens multitrillion-dollar social policy and climate action spending bill a tax on wealthy peoples unrealized capital gains. It has already been a long year of new taxes tax hikes and even more tax proposals.

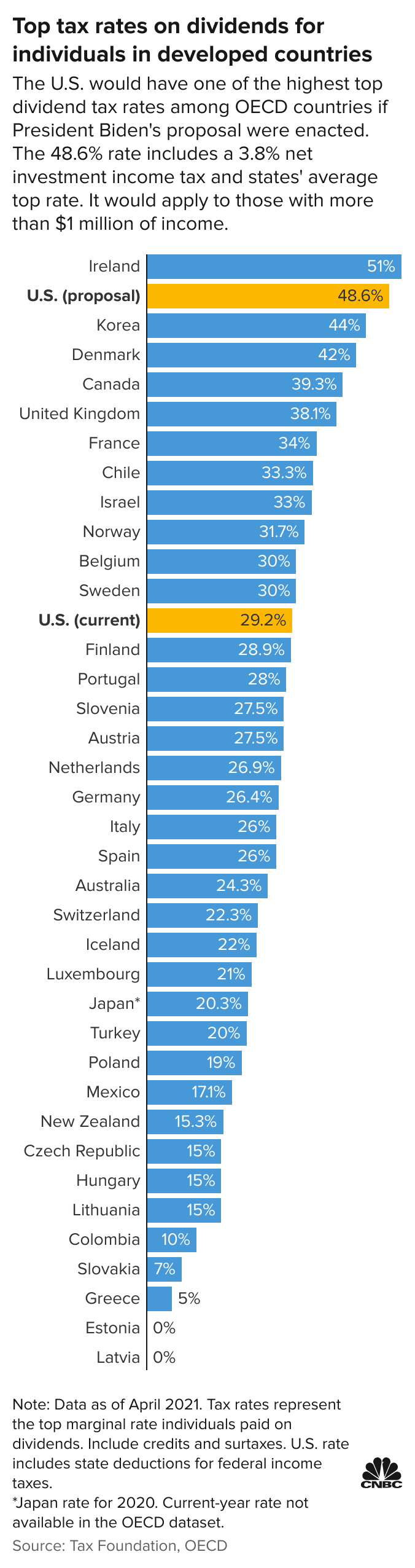

Theres been a lot of debate this week over President Bidens latest budget plan which includes a proposed tax on the unrealized gains of assets owned by billionaires. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408. The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold.

When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Any fair tax system would give that investor the ability to offset gains with losses as is generally the case elsewhere in the tax code.

The final price could well. The Tax Would Likely Grow to Hit Millions of Americans Over Time The tax would apply to taxpayers. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains.

Unrealized gains are not generally taxed. 30 2021 Published 1040 am. The tax on unrealized gains faces hurdles.

A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill. How might it change the best investment strategies.

Sarah SilbigerBloomberg via Getty Images. The impacted assets include stocks bonds real estate and art. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and unrealized capital gains of.

Ten Reasons to be Concerned with Bidens 20 Percent Tax on Unrealized Gains 1. This article is in your queue. The tax would apply to people who make more than US 100 million a year for three years in a row or if one makes US 1 billion in annual income.

Kyrsten Sinema D-Ariz and Joe Manchin D-WV to 2 trillion. Wealth Wealth in Stocks Estimated Taxable Gains Tax Owed. October 25 2021.

To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. For these 13 billionaires total unrealized gains add up to more than 1 trillion. Households worth 100 million or more is drawing skepticism from tax experts.

March 26 2022 229 PM PDT. The Democrats plan for a 35 trillion spending bill has been pared by moderate lawmakers led by Sens. The main reason you need to understand how unrealized gains work is to know how it will impact your tax bill.

What Does the Proposal To Tax Unrealized Capital Gains Mean for Americans. Households worth more than 100 million as. 20 Minimum Tax on Unrealized Gains in Billions Payable in Nine Years.

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. 0000 0138. Unrealized capital gains are increases in value of stock purchases.

The Tax would Empower The IRS In order to enforce this tax the IRS would have to be given vast new powers to value. You dont incur a tax liability until you sell your investment and realize the gain.

What Is Unrealized Gain Or Loss And Is It Taxed

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Incentive Management

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

The Unintended Consequences Of Taxing Unrealized Capital Gains Usgi

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

The Coming Tax On Unrealized Capital Gains

Crypto Tax Unrealized Gains Explained Koinly

Biden S Better Plan To Tax The Rich Wsj

Crypto Tax Unrealized Gains Explained Koinly

Bitcoin Gains Can Become Tax Free Investing In Cryptocurrency Cryptocurrency Bitcoin

Will The Unrealized Capital Gains Tax Proposal Apply To Most Investors The Motley Fool

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Unintended Consequences Of Taxing Unrealized Capital Gains

Build Back Better Legislation Tax On Unrealized Capital Gains Does Not Pass The Fairness Test Ethics Sage

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too